The term dividend denotes that part of company's balance of profit (after the execution of its 'Retained Earning'), which is available for equal distribution amongst the shareholders (investors) of the company. Dividends are a form of incentive to the shareholders for having invested in the company's shares. This is the return out of the profit made by a company during a year, for its shareholders (beneficiaries).

Rate of interest in not fixed.

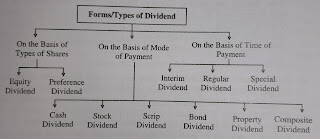

Dividends which are distributed among preference shareholders. The of dividend is fixed.

During the Annual General Meeting, the recommendation of BoD is approved by the shareholders and the process of "declaration of cash dividends" is finished. A declared cash dividend is part of shareholder's equity (and not a liability of the company), as decision in the matter may be reversed. On Treasury Stocks, no cash payments are made.

Sometimes, when the profits made by a company are substantial, it may decide to retain a part thereof by capitalising and retaining it in the business perpetually by issuing stock dividends (additional or bonus stocks/shares in lieu of cash)

3. Scrip Dividend

In a situation, where in a company is:

a) Suffering from a temporary liquidity crunch, and

b) Has an adequate level of retained earnings.

It may decide to issue Scrip Dividends' in lieu of 'Cash Dividends'.

'Scrip Dividends' may be issued either as 'Promissory Notes' (which may be discounted before its 'due date') or 'Ordinary Shares'.

4. Bond Dividends

'Bond Dividends' may be defined as 'dividend distribution that is paid to shareholders in the form of a bond or debenture (debt instruments) instead of cash'.

It has fixed rate of interest for long duration.

Issue of 'Bond Dividends' is opted by a company under the same situation as that of issue of 'Scrip Dividends', and have the same impact.

5. Property Dividend

'Property Dividend' is an alternative to 'Cash Dividend', 'Scrip Dividend' or 'Bond Dividend'.

It is rather an uncommon payout structure, in which there is transfer of non-monetary asset between a company and its shareholders on a non-reciprocal basis.

6. Composite Dividend

When dividend payment involves two or more types mentioned in the foregoing types, it is known as 'Composite Dividend'.

C. On the Basis of Time of Payment

1. Interim Dividend

Dividend is normally declared in the Annual General Meeting (AGM) of a company after the finalisation of the balance sheet at the end of a financial year.

However, at times the dividend is declared and paid before the finalisation of the balance sheet or before AGM of a company.

Such dividend is rightly termed as 'Interim Dividend' and is paid when the Management/Board of the company has reasons to believe that the company has already earned enough profits.

2. Regular dividend

The dividend declared during AGM in normal course of business.

3. Special dividend

In the year of huge profits, company may consider distribution of special dividend.

It is a one time affair.

•••••••••••••••••••••••••••

Scope of dividend function

1. Legal position

There will be legal restrictions by different countries on the total dividend amount being paid.

2. Profitability

Is order to pay dividends, it is important to have some kind of profits. Greater profitability, greater amount of dividend and vice versa.

3. Infation

The opeartional capacity of any organization can be depleted if dividends are paid depending on past cost profits when inflation rate is high.

4. Growth

As the majority of the revenue is reserved for the financial development, very low dividends are paid by the fast developing organisations.

5. Control

There will be no change in the control or ownership due to utilisation of internally generated revenue. Especially the family governed organisations will be more benefited from it.

6. Liquidity

In order to pay the dividend, it is important to have adequate liquid funds.

●●●●●●●●●●●●●●●●●●●●●●●●●

Meaning & definition of Dividend policy

According to Weston and Brigham, "Dividend policy determines the division of earnings between payments to shareholders and retained earnings".

The 'Dividend Policy' of a company needs to be framed by its management in such a way that the net earnings are split into 'Retained Earnings' and 'Dividends' in an appropriate manner.

This framed policy should also meet both the objectives of:

1) Business growth, and

2) Maximisation of wealth for its shareholders.

The decision of breaking the 'Net Profit' (post-tax) into two parts, viz.:

1) Retaining in the business for the growth of the company, and

2) Distributing to shareholders as 'Dividend',

It is a crucial one, having long-term impact on the future prospects of the company.

Nature of dividend policy

- Close relationship with retained earnings

- Impacts the future financial decisions

- Impacts the share

- Directly impacts market price of share, liquidity position, growth rate, etc.

- Optimizes dividend structure

Why Firms Pay Dividends

Shareholders of the company are entitled to receive the dividend as profit on the capital contributed by them. The proportions of earnings for dividend and money retained in the company are decided by the board of directors of the company.

Execution of dividend payout

- Lack of enough growth opportunities & future plans

- Consistency I regular Cash flows for new instruments

- Investors find dividend paying companies more attractive for investment

Based on the dividend payouts, the investors can make following estimations:

i) The company is financially sound, or

ii) It is capable to provide stable returns, or

iii) The company's management is confident about its future earnings.

Thus, their positive opinions about the dividend payment will increase the demand for company's shares as more demand for company's shares will automatically raise the prices of shares.

Essentials of Sound Dividend Policy

Dividend policy decisions are strategic and long-term in nature. Their purpose is to achieve shareholder's wealth maximization. Following are the main characteristics of a good dividend policy:

- Distribution of dividend in cash

- Initial lower dividend

- Gradual increase in dividend

- Stability

- Dividend out of earned profits

Types/classification of dividend policy

1) Regular Dividend Policy:

A company having a steady stream of income may prefer this category of 'Dividend Policy'. It means payment of dividends on a regular basis, even if the rate of dividend is low. In other words, the focus is on the regularity of dividend payout rather than on it rate.

It's suits investors, who are:

- Retired person

- Person belonging to low income level

2) Stable dividend policy

This category of dividend policy ensures regular payment of fixed percentage out of a company's annual income to the shareholders.

It has three sub categories:

- Constant dividend per share(reserve fund is created)

- Constant payout ratio (fixed % is given)

- Stable plus extra dividend (extra dividend in the year of higher profit)

3) Irregular dividend policy

When a company does not pay regular dividends to its shareholders because of certain reasons.

4) No dividend policy

Sometimes a company may like to keep its entire net profit as retained earnings for the purpose of business growth and expansion.

Determinants of dividend policy

Legal bounding

Dividend policy should be compliant with various statutory provisions under companies act 1956.

Size of earnings

Investment opportunities and shareholders preference

Company should maintain a balance between shareholder's expectation and utilization of routine earnings for investment

Liquidity position

As dividend payout to shareholders involves cash outflow. Hence, it is important while formulating dividend policy to make provisions for liquidity status prevailing in a company.

Company's intention towards control

State of capital market and access to it

Contractual restrictions

When a company borrows funds from external sources certain restrictive clause may be imposed by the lender

Profitability and stability of earnings

A company's investment in high yielding instruments would fetch huge profit for the company and ice versa.

Inflation

Every year due to inflation, cost of replacing fixed assets increases hence, the fund accumulate as a depreciation fund becomes insufficient for replacing assets.

Thus, while formulating dividend policy this factor should be kept in mind.

Relevance/Importance of dividend decision

- An optimal dividend policy can maintain a balance between the business growth and maximization of shareholders wealth.

- It is a decisive force in shaping the market value of a company.

- Rate of dividend payout symbolizes a company's competence to do business effectively and generate revenue.

- Decision regarding dividend payment may impact a company's external financing plans in an indirect manner.

- Market value of share price is impacted in a negative manner if the rate of dividend distributed by a company is low.

In simple words, dividend policy of a company holds a very important role which is capable of influencing the financial health, fund management, liquidity status and growth of a company.

Issues with dividend decisions

1. Information signaling

The management cannot disclose any information of the company to investors. Due to this, a communication gap arises between the management and shareholders which can be even positive or negative in consequences.

2. Clientele effect

Investors have different types of demand and the clientele effect refers to the preference of investors of the company.

According to the presence of clientele effect, it suggests that the firm will get investors according to their demand & the firm cannot change its regular dividend policy.

3. Cost of capital

It helps to decide whether the distribution of capital is to be done or not.

4. Objective realization

The dividend policy formulated by a firm should follow the objectives of shareholders' wealth maximization

Dividend models

Maximization of a company's value is closely linked in direct proportion to the maximization of it's shareholder's wealth.

The theory of relevance is supported by professor Walter and professor Gordon and the theory of irrelevance is propounded Modigliani and Miller.

1.A) Walter's Model

Professor Walter proposed a model which maintains that a dividend policy of a company is applicable in ascertaining its networth.

According to this model dividend received by the shareholders of a company are reinvested by them onwards to have higher rate of return.

From the company perspective, the cost of dividend paid to the shareholders is considered as opportunity cost or the cost of capital of the company and dividends which are not being paid to the shareholders could have been used at as capital by the company.

In other scenario, a company decides not to pay dividends to its shareholders and instead invest the amount of dividends in some remunerative avenues used to earn a better rate of return.

Assumptions of Walter's model

- Internal Financing

- Constant return and cost of capital

- Cent per cent payout Or retention

- Constant EPS and D

- Infinte time of business survival

Criticism of Walter's model

- It is more hypothetical in nature and less

- practical.

- It considers no external financing, constant return as well as constant opportunity cost or cost of capital.

1.B) Gordon's model

This model is postulated by Myron gordon and John Lintner independently and is also referred to as "bird in hand theory".

This theory is made from the phrase "a bird in the hand is worth two in the bush" where a bird in the hand is used for 'dividend' and Bush is used for 'capital gains'.

This theory says that investor prefers to have fixed a dividend payout compared to getting capital gains from the investment in stock.

Assumptions of Gordon's model

- All equity company

- No external financing

- Constant rate of return and cost of capital

- No taxes

Criticism of Gordon's model

Gordon's model has similar assumptions as Walter's model and hence, both of the models are criticized for the same reason.

2.A) Modigliani nd Miller hypothesis/model

Under the MM model, a view was held for the investors that the dividend and capital gain are nothing but return on their investment.

The value of company therefore, depends upon its earning which is the outcome of it's :

i) Investment policy and

ii) Overall performance of the industry

The dividend policy of a company has got nothing to do with its valuation.

Assumptions of MM model

- Perfect capital market

- (Which means:

- Investors are reasonable and logical

- There is transparency as well as no flotation cost involved)

- No taxes

- Fixed investment policy

- Risk is not involved

Criticism of MM model

- It does not consider tax differentials which is unrealistic.

- It does not consider flotation cost, as well as,

- It restricts investors from diversifying their portfolios.

- It does not consider risk factor.

2.B) Traditional/Residual model

This approach is founded by Graham and Dodd.

This theory is relevant to determine the market value of share.

According to the traditional approach, out of net profit enough cash is set aside as retained earnings which is used for investment in profitable projects.

The residual of net profit of a company is available for distribution among the share holders.

Criticism of residual model

Although there is no practical evidence to support this model but it is obviously convincing and a logical model because most of the companies prefer to fulfill their investment and growth strategies before paying the dividends to their shareholders.

The better the learnings the better the earnings😎

To get in depth knowledge of these topics you can also look into it 👉👻

Thank you for reading🙏😊

Stay tuned and remember that you are "EXAMBLASTERS" powered by ●EASY NOTES●

Comments

Post a Comment